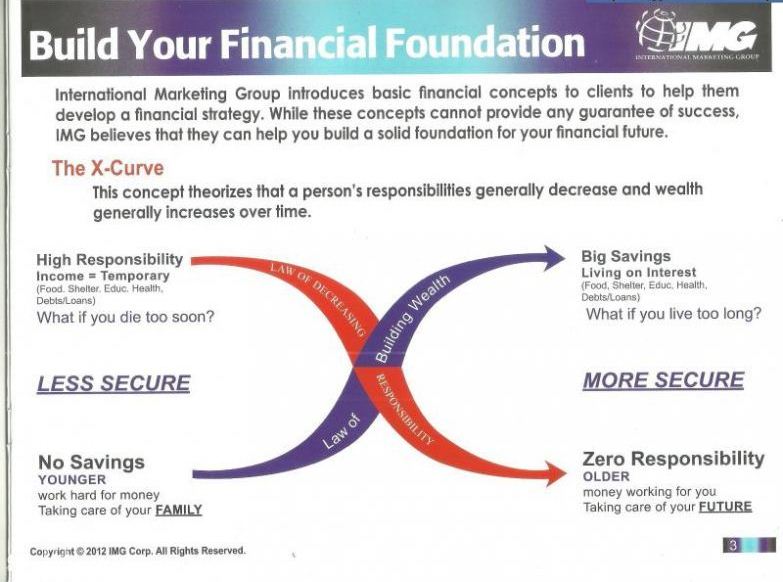

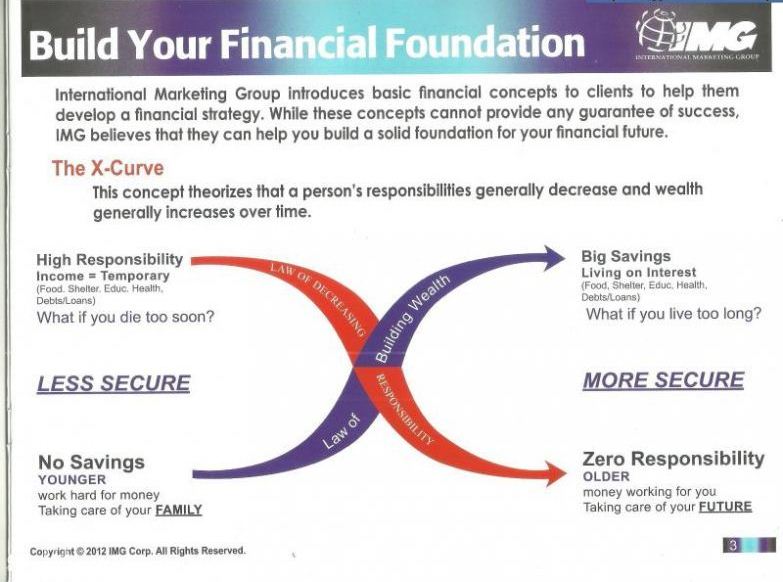

We believe that, before we could start investing or experience financial freedom, we need to ensure our protection. This is the 4th level of Financial Security. Let me explain about the X Curve which you could also see in our Team Logo. This is still part of Financial Security Series

Image Courtesy of IMG Philippines

What Financial X Curve?

Financial X curve gives you an idea about protection and security of a person. This concept theorizes person’s responsibilities generally decreases and wealth generally increases over time as shown in the picture.

Let me discuss about the Responsibility, the younger we are the higher the responsibility. As an example while we are young we spend a lot for our own family or our parents, we spend for our children’s necessities such as school, food, clothing, education, health care and other primary needs, which only means that they are all depending to us while we are young. As we go older, mortgage is being completed, children finished their education, you have your own car or even you have your own house and therefore older people’s responsibility is less during the old days. That is what we called Law Of decreasing responsibility.

As we increase our responsibility the need of being insured is higher compared when you get older. The resources that you need for your responsibilities should be equal to the protection that you have. In short, you need to be secured while you are young, so that whatever happens to you, your family or those love ones will left behind will not have problem about the responsibilities that you left.

For further reading you may check Wikipedia -https://en.wikipedia.org/wiki/Theory_of_Decreasing_Responsibility.

The next part of the X curve is the Law of Building wealth, it means that while we are young our wealth is little and sometimes nothing. It is the time where we accumulate wealth so that when we get old we have investment where our money can work for us through it’s interest. Most of the income while we are young is active income while income when we become old should be passive income.

Active income means when you stop working you will not have any money or the cash flow will stop. Passive income means a continuous stream of income were money will be working for you, even you stop working or giving effort in making money, money will still flow. This could only be done through proper investment.

But of course before you invest you need to make sure your protection is properly dealt with. Your life Insurance and Long Term Health Insurance is a must to do in order to make a good foundation for your investment.

In the Law of Building Wealth, when you got old, interest of your investment will be used to satisfy your needs for your health care, food, recreation and other necessities.

The X Curves tells us that as we go old, we need to be more secure and our responsibility should be less.

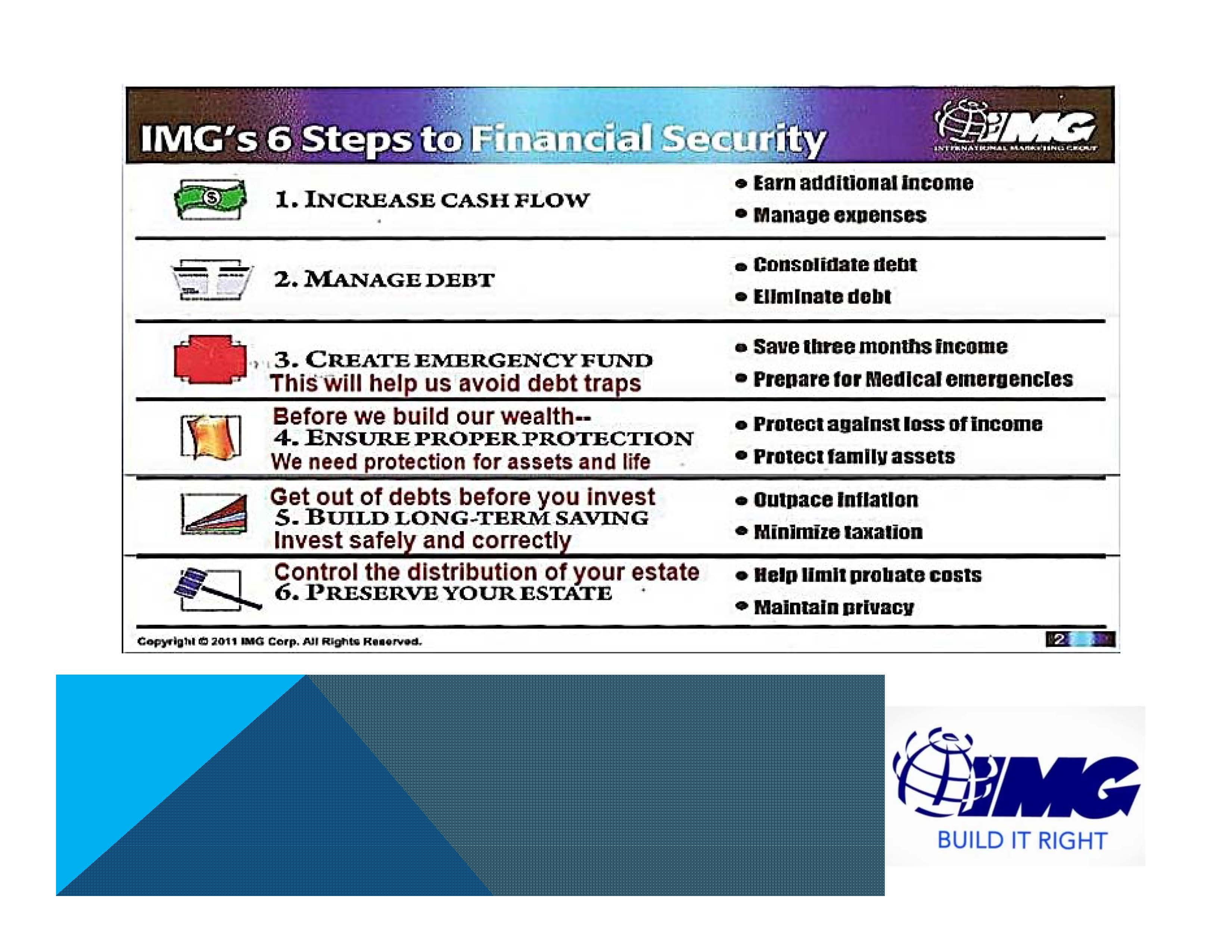

Part of 6 Steps to Financial Security Series