Ako si Juan OFW sa Saudi — at alam natin na kahit kelan maaaring humipo ang global market kahit tayo sa Pinas. Ano nga bang mangyayari sa real estate kapag tumindi ang gulo sa Middle East?

1. OFW Remittances: Steady… For Now

Ang pinakahuling datos: remittances mula sa Israel at Iran ay maliit lamang sa pambansang total—US $106.4M noong 2024, humigit-kumulang 0.3% ng lahat ng remits . Kaya sa ngayon, “walang malakihang epekto” .

Pero tandaan: kung mag-escalate na sa buong Middle East at maraming OFWs maapektuhan—lalo na sa Saudi/UAE region—baka bumagal ang remittances na critical sa demand ng real estate

2. Oil Prices: Pressure Cooker sa Construction Costs

Tuloy-tuloy ang spike ng oil prices tuwing may gulo sa Middle East—tulad ngayong junio 2025, Brent at WTI tumalon ng ≥4% dahil sa air strikes.

Resulta? Ang construction costs ironically tataas: gasolina, transportasyon, materials—petrochemical-based paints, plastics—all may mahal. Yung bagong condo mo, baka mas mahal ang buo development.

3. Investor Sentiment: Dalawang Mukha ang Kwento

Risk-off phase: Sa first reaction, malamang investor confidence bumabagal. Developers baka i-slowdown ang bagong projects; foreign buyers baka mag-pause muna.

Pero…andami bago sabihan: Sa kabilang banda, ang real estate ay minsan tinuturing na “safe haven” lalo na sa panahon ng market uncertainties (crypto, stocks, bonds na volatile). Kaya baka mag-shift yung ibang investors—lalo na OFW families—papunta sa stable assets like housing.

4. Peso Stability & Inflation

Mataas na oil prices → global inflation → tataas ang cost of living sa Pinas (~inflation). Dito makakalimutan ng unsheltered buyers lalo na mga nasa threshold lang ng kaya nilang monthly amort.

Pero, remittances rin ang nagpapalakas ng peso, kaya real estate interest ng OFW families nagpapatuloy, depende rin sa pangkalahatang ekonomiya

Ano Kaya ang Dapat Gawin?

Risk Management for OFWs

- Huwag ilagay lahat ng investments sa isang basket. Mix it up: may balat sa stocks, crypto, pero andun din ang real estate.

- Emergency fund ready—para if makawala ang gulo, hindi agad maaapektuhan yung investments.

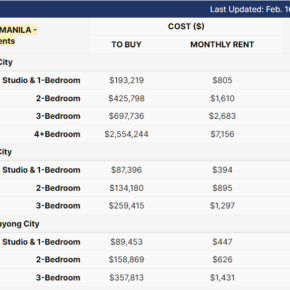

Choose Strategic Locations

- Konsiderahin ang lugar na may strong demand mula sa middle-income OFW families—suburbs near BGC, QC, Cebu, Davao.

- Infrastructure, proximity sa trabaho at public transport, pati amenities—check!

Anticipate Inflation Effects

- Filter yung projects na may “inflation buffer” o price escalation clauses, lalo na yung materials cost sensitive.

Watch Oil & Remit Data

- Setup quick watchlist sa remittance reports & oil prices. Ramdam mo agad dapat ang pagbabago—so you can pivot investment strategy, fast.

💡 Final Take: Balanseng Kumbaga ng OFW Investor

Short‑term: remittances steady pa rin, pero possible spikes in oil price plus investor caution.

Mid‑to‑long term: Maaaring maging magandang oportunidad ang real estate bilang protective shelter para sa pamilya mo—provided nakaantabay ka at na-manage mo ang risks.