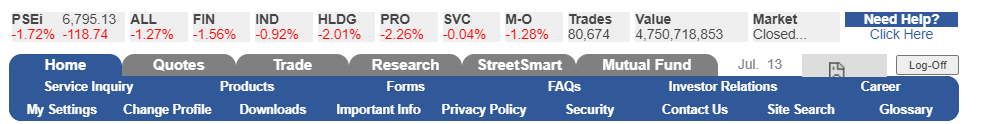

Despite the First Quarter 2013 GDP report that grows with 7.8%, ahead of estimates, the market still fails to recover from it’s lost that started last week.

If you are like me who does not really understood what GDP means, except that I know it’s a country’s economic growth calculation, I have researched the meaning from investopedia.com as follow:

What is GDP?

The gross domestic product (GDP) is one the primary indicators used to gauge the health of a country’s economy. It represents the total dollar value of all goods and services produced over a specific time period – you can think of it as the size of the economy. Usually, GDP is expressed as a comparison to the previous quarter or year. For example, if the year-to-year GDP is up 3%, this is thought to mean that the economy has grown by 3% over the last year.

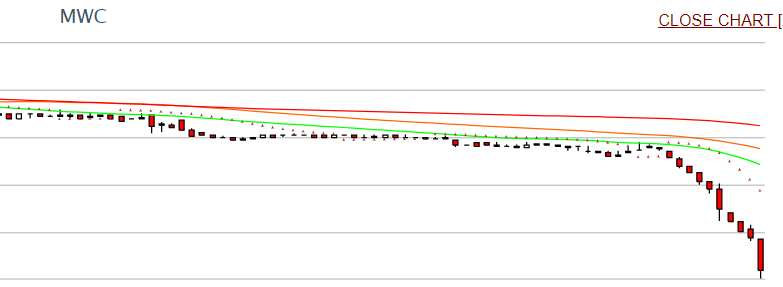

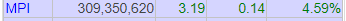

The market continues to goes down as of this writing. Nobody really knows until when will be this Philippine bullish market will end and bounce back.

As a long term investor, don’t panic. I still believe that it is just a market correction and still not a market crash.

Did you remember that the market started the year at 5,860.99 which is actually a record high on that time, and market closed today at 6953.35 which is 18.63% higher than it’s opening price also known as YTD.

YTD %

The percent gain or loss that the portfolio has achieved over the Year To Date (YTD) period. Refer to the “as of” date to determine the exact period.

Since I am in the stock market for almost 1.5 years, I don’t have this problem of panic, I know it’s just part of the market cycle.

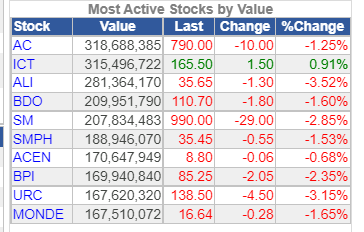

For investors, this is really a good time to buy since the market is down and there is really a good chance that the market will bounce soon. Investors have 2 option if they have money to buy more stocks.

1.) Buy on stages ( aka Peso Cost Averaging)

2.) Buy until the market is on it’s lowest price.

Number 1, is easier because you will be doing cost averaging. On number 2, nobody really knows when it will be up or until when it will be bullish. Yes there is Technical Analysis, but when the market is affected by outside force, nobody knows what might happen.

I have read a news about “BASE III” but I still need to understand the effect of this to Philippine Economy or I can say Global Economy. Read More about BASE III here and here

For research purpose, I have copied some information in the net about this article:

What is BASE III

“Basel III” is a comprehensive set of reform measures, developed by the Basel Committee on Banking Supervision, to strengthen the regulation, supervision and risk management of the banking sector. These measures aim to:

- improve the banking sector’s ability to absorb shocks arising from financial and economic stress, whatever the source

- improve risk management and governance

- strengthen banks’ transparency and disclosures.

The reforms target:

- bank-level, or microprudential, regulation, which will help raise the resilience of individual banking institutions to periods of stress.

- macroprudential, system wide risks that can build up across the banking sector as well as the procyclical amplification of these risks over time.

What is BIS?

As shown in Wikipedia:

The Bank for International Settlements (BIS) is an international organization of central banks which “fosters international monetary and financial cooperation and serves as a bank for central banks”.[2] As an international institution, it is not accountable to any single national government.

The BIS carries out its work through subcommittees, the secretariats it hosts and through an annual general meeting of all member banks. It also provides banking services, but only to central banks and other international organizations. It is based in Basel, Switzerland, with representative offices in Hong Kong and Mexico City

All I can say is that stay with your plan, if you cannot handle the loss then make a cut loss, and if not just close your online broker account and watch some movie. Do some research. For long term investor, like those people in Equity Mutual Fund, relax and wait for the rebound.

Always remember the Higher the Risk the higher the possible Returns, The Lower the Risk the Lower the possible returns. So it’s up to you on which investment path will you go.

The best thing to do is to study first. Remember that you don’t have to be emotional when it comes to stock market movement.

For OFW, Our exchange rate today is Php 42.36 : 1 USD, good for us.

Happy to report that after the closing today I still have 19.5% Gain YTD.