I just learned that FinanceManila.net has been acquired by ADVFN Plc (“ADVFN” or the “Company, for about Php 6 Million payable as PHP2.5 million in cash and PHP3.5 million inf new ADVFN shares of 1p each as reported in online.wsj.com.

“I am delighted to announce the acquisition of Finance Manila which, in my view, is the most exciting trader community in the Philippines. Financemanila.net hosts large, active investor communities, which I believe are a perfect match for ADVFN’s premium subscription and advertising offerings. We will use the Investors Hub template we have developed in the US to take the site to the next level and accelerate ADVFN’s planned expansion into the fast growing markets of Asia.” said Clem Chambers, CEO of ADVFN.

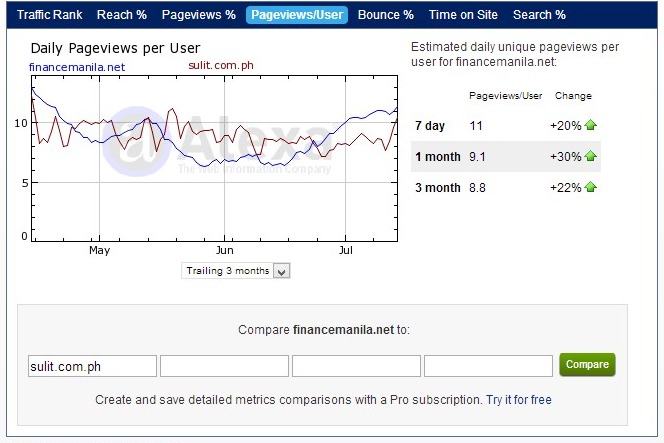

Just to give you an idea about the traffic of financemanila.net I made a comparison with sulit.com through alexa graph pageviews/user. The graph shows the margin of difference when it comes to pageviews/user. It also shows that it has almost the same pageviews/user of sulit.com.ph, which another successful pinoy website that becomes a business venture.

According to who.is, Finance Manila has been registered and become online since October 18, 2004. In just 9 years this website has attracted millions of visits per month and has a reported 2 Million Page Views per month.

So is it a good buy? Let me do some calculation as follows:

2,000,000 Pageviews x 0.05 (Ad Clicks Rate) x $0.05 (cost per click) = $ 5,000 per month x Php 43/1 $ = Php 215,000 per month

So based on my calculation ADVFN can have its ROI for its cash payment in just a matter of 1 year, as long as the financemanila.net will hold its visitors or even increase its visitor. It is a good decision from ADVFN since lots of Filipino are now starting to learn about Financial Literacy. This is story is another success stories of the those netrepreneur that started earlier than most of us.

Congrats to FinanceManila.net and to ADVFN partnership.

They probably didn’t buy it for the ad clicks:)

ADVFN is like bloomberg right? but more on stocks? I think they bought the memebers/users strange as that might sound. No sense putting up a website of their own and risk losing the race to dominance to another competitor. (specially considering most pinoys still follow the suki system, even if unconciosuly – not that they probably know that).

But that’s beside the point. Congrats to dragon (whatever his real name is) and more power to FinanceManile. They built a great community and now they’re reaping the rewards.

(where’d you hear it by the way?)

It was mentioned in the WSJ – http://online.wsj.com/article/BT-CO-20130708-700378.html. Site acqusition is norm in online business it is also what google is doing that is why they expand. So whos next? PinoyMoneyTalk.com?

Maybe. but despite being #1 in visitors (according to top blogs; FinanceManila is #2), they’re less focused. In contrast, Finance Manila is almost exclusively on stocks.

But heck, I didn’t even think Finance Manila would get bought.

Dexter, what is Alexa? Is it a credit valuation site of some sort? What are those figures about 7 days, 1 month and 3 months? Are those credit ratings or other metrics? I saw the term “bounce” too does that mean stocks bounces on stock valuation?

Thank you in advance for the response.

No, Alexa is a site that measures visit, page views . This is actually a website data. It gives you an idea on how popular or how often the site is being visited by different person. It does’nt have any connection with Stocks or finance. Bounce gives an idea on how many people are staying on a certain website after they have found it.

Thanks Dexter! I will check out the site myself and check PSE Trading Academy as an example.

Hi,

I was looking for information regarding FinanceManila. I just discovered it today and I was wondering if the ratios listed for companies there are legit. See sample below.

http://fm.advfn.com/stock-market/PSE/jollibee-foods-corporation-JFC/financials

I have a bunch of ratios listed as my personal indicator of a good buy stocks. I am not sure if I should trust what is listed in finance manila. Please help.