Tags

ALI, AyalaLand, BankOfThePhilippineIslands, BDO, BDOUnibank, Bloom, Bloomberry, BPI, ICT, InternationalContainerTerminalServices, InvestingInThePhilippines, MBT, Metrobank, OFWInvestor, PhilippineStocks, PinoyStockMarket, PLUS, PrimeInfrastructure, PSEi, PSEMarketUpdate, SM, SMInvestments, SMPH, SMPrime, SolarPhilippines, SPNEC, StockMarketNews

The Philippine Stock Exchange experienced a volatile trading session today, with several major stocks recording significant losses. Here’s a summary of the top movers:

🔻 Biggest Decliner: PLUS (Prime Infrastructure Capital Inc.)

- Closing Price: ₱29.50

- Change: -₱9.25 (-23.87%)

- PLUS saw a sharp decline, wiping out nearly a quarter of its value in a single day. This could be due to profit-taking, investor sentiment shifts, or recent developments affecting the company.

🔻 Notable Declines:

- BLOOM (Bloomberry Resorts): ₱4.29, down ₱0.41 (-8.72%)

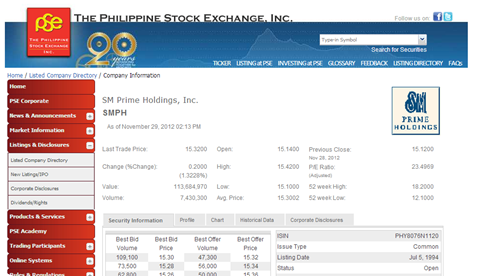

- SMPH (SM Prime Holdings): ₱23.55, down ₱0.90 (-3.68%)

- ALI (Ayala Land): ₱27.20, down ₱0.70 (-2.51%)

- SM Investments Corp: ₱885.00, down ₱17.00 (-1.88%)

- BPI (Bank of the Philippine Islands): ₱124.70, down ₱2.30 (-1.81%)

These drops indicate a broad-based sell-off across property, banking, and consumer sectors.

🟰 Stable Performer:

- ICT (International Container Terminal Services, Inc.): ₱419.00 (no change)

ICT remained flat, showing relative stability amid market fluctuations.

🔺 Gainer of the Day: SPNEC (Solar Philippines NEC)

- Closing Price: ₱1.45

- Change: +₱0.20 (+16.00%) SPNEC emerged as the top gainer, likely buoyed by strong investor interest in renewable energy stocks or recent positive news.

🔼 Slight Gains:

- BDO Unibank, Inc.: ₱155.00, up ₱0.40 (+0.26%) BDO showed resilience with a small gain, possibly reflecting continued investor confidence in its fundamentals.

🔽 Minor Decline:

- MBT (Metrobank): ₱71.15, down ₱0.35 (-0.49%)

📌 Summary:

Today’s market movement reflected risk-off sentiment, with heavy losses in infrastructure, gaming, property, and banking sectors. Despite the sell-off, SPNEC stood out with a notable surge, possibly indicating strong retail investor interest.

For long-term investors, this could be a chance to accumulate quality stocks at lower prices. However, it is crucial to monitor company-specific developments and market trends before making any decisions.