Tags

Financial Literacy, Investing, Investment, Newbie Investor, OFW, Personal Finance, Stock Market, Stocks

Sa nakaraang mga buwan, marami sa atin ang nagtataka kung bakit patuloy na bumababa ang stock market. Hindi lang ito nangyayari sa Pilipinas kundi maging sa buong mundo. Sa blog post na ito, tatalakayin natin ang mga pangunahing dahilan sa likod ng pagbaba ng stock market at kung paano ito nakakaapekto sa mga Pinoy na investor.

Pangunahing Dahilan sa Global na Sitwasyon

1. Geopolitical Tensions

Ang mga kaguluhan sa iba’t ibang bahagi ng mundo tulad ng patuloy na giyera sa Ukraine at Russia, at ang kamakailan lang na tensyon sa Middle East ay nagdudulot ng malaking epekto sa global market. Ang mga ganitong sitwasyon ay nagdudulot ng uncertainty at risk-aversion sa mga investor.

2. Inflation at Interest Rates

Ang US Federal Reserve at ibang central banks sa mundo ay patuloy na nagpapatupad ng mataas na interest rate upang labanan ang inflation. Kapag mataas ang interest rate, mas mahal ang pag-utang para sa mga kompanya, at mas kaunti ang pera na umiikot sa ekonomiya. Nagresulta ito sa pagbaba ng stock prices dahil nabawasan ang future growth expectations.

3. Pangamba sa Global Recession

May mga senyales na nagpapahiwatig na malapit nang pumasok sa recession ang ilang malalaking ekonomiya sa mundo. Kapag bumaba ang consumer spending at business investments, direktang naapektuhan ang corporate earnings na siyang nagdudulot ng pagbagsak ng stock prices.

Sitwasyon sa Pilipinas

1. Pagbaba ng Philippine Peso

Patuloy ang pagbaba ng halaga ng Philippine Peso kontra sa US Dollar. Ito ay nakakaapekto sa mga kumpanyang may malalaking utang sa dolyar at sa mga negosyong umaasa sa imported goods.

2. Mataas na Inflation Rate

Kahit bumababa na ang inflation rate sa Pilipinas, mataas pa rin ito kumpara sa target ng Bangko Sentral ng Pilipinas. Ang mataas na presyo ng bilihin ay nagpapababa sa purchasing power ng mga konsyumer, na nakakaapekto sa kita ng mga kompanya.

3. Politikal na Sitwasyon

Ang kasalukuyang administrasyon ay nahaharap sa iba’t ibang hamon – mula sa pagharap sa epekto ng pandemya, hanggang sa mga isyung pang-ekonomiya at geopolitical challenges. Ang mga policy decisions at political stability ay direktang nakakaapekto sa investor confidence.

4. Outflow ng Foreign Investments

Dahil sa mataas na interest rates sa US at iba pang developed markets, maraming foreign investors ang nag-pu-pull out ng kanilang investments sa emerging markets tulad ng Pilipinas at nilipat ito sa mas “ligtas” na mga market.

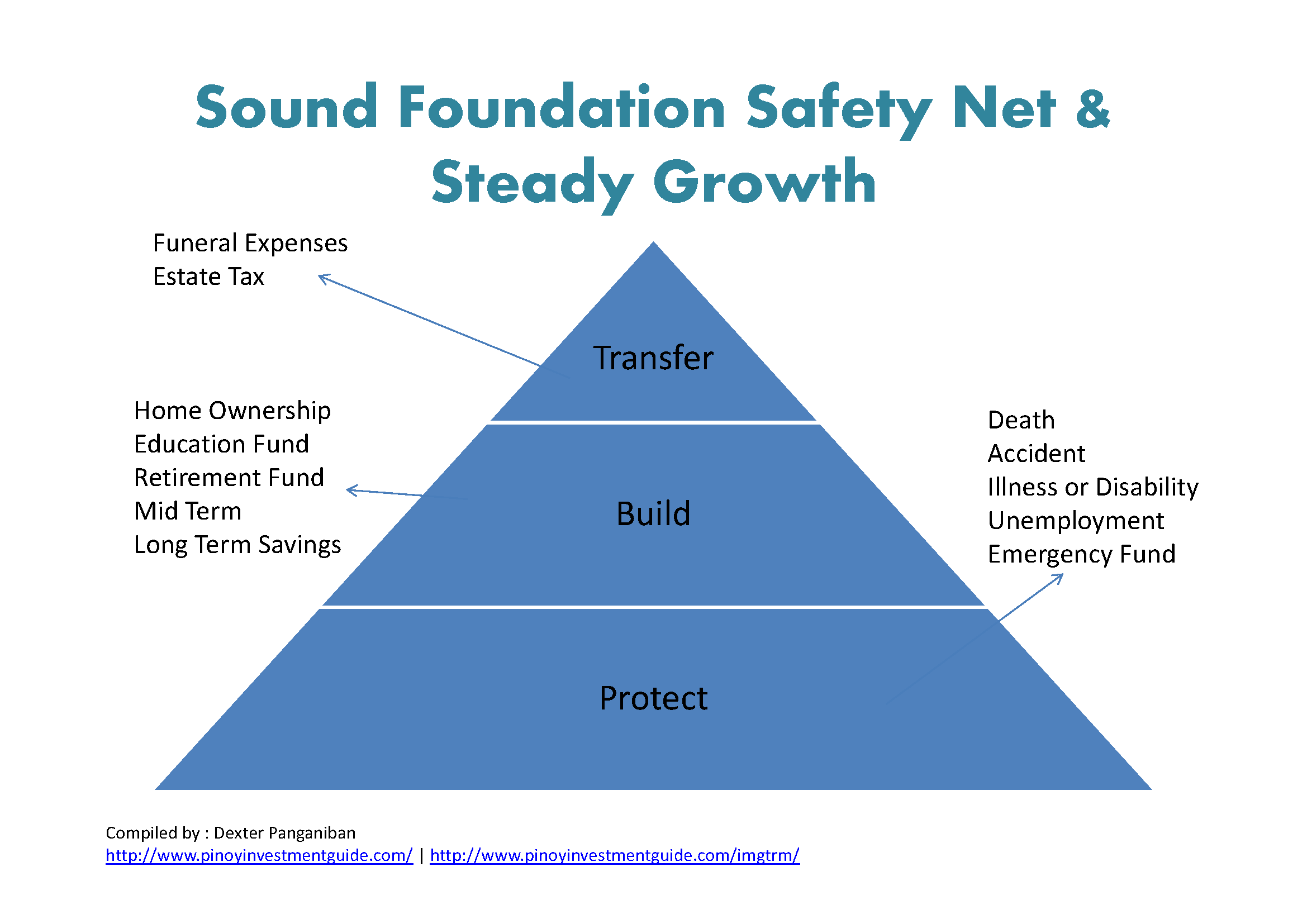

Ano ang Ibig Sabihin Nito Para sa mga Pinoy Investors?

1. Pagkakataon para sa Long-term Investors

Sa kabila ng pagbaba ng market, ito ay maaaring magandang pagkakataon para sa mga long-term investors na bumili ng mga quality stocks sa mababang presyo. Tandaan ang kasabihan: “Be fearful when others are greedy, and greedy when others are fearful.”

2. Importansya ng Diversification

Ngayon higit kailanman, mahalaga ang pagkakaroon ng diverse portfolio – hindi lang sa stocks, kundi pati sa ibang asset classes tulad ng bonds, real estate, at kahit crypto para sa mga risk-tolerant investors.

3. Pag-iwas sa Panic Selling

Maraming investors ang nagpapanic at nagbebenta kapag bumababa ang market, pero kadalasan ito ang pinakamalaking pagkakamali. Importante ang pag-assess ng iyong investment timeframe at risk tolerance.

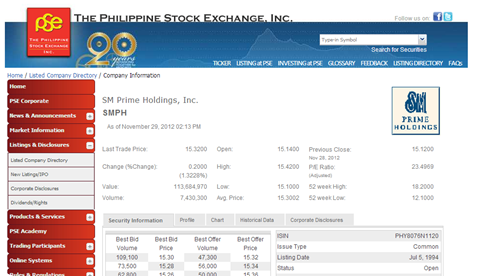

4. Focus sa Fundamentals

Sa panahon ng market downturns, mas mahalaga ang pag-focus sa fundamental strengths ng mga kumpanya kaysa sa short-term price movements.

Conclusion

Ang pagbaba ng stock market ay normal na bahagi ng economic cycle. Bagamat nakakakaba para sa mga investors, lalo na sa mga baguhan, kailangan nating tandaan na ang investing ay isang mahabang paglalakbay. Ang mga market corrections ay nagbibigay ng pagkakataon para sa mga matalinong investors na bumili ng quality assets sa discount.

Sa mga susunod na buwan, patuloy nating bantayan ang mga developments sa global at lokal na ekonomiya, at mag-adjust ng ating investment strategy ayon sa ating personal na financial goals at timeframe.

Ano ang inyong estratehiya sa kasalukuyang sitwasyon ng market? Ibahagi sa comments section at magkaalaman tayo!