Tags

BPI Philam, DIME method, Insular Life, Insurance, Life Insurance, Manulife (Phils), Manulife Chinabank Life, Phil AXA, Philam Life & Gen, PNB Life, Pru Life, Sun life, SunLife Grepa

First of all, who needs an insurance? And why do you need an insurance?

An insurance is a need for those people whom somebody is depending on their income. An insurance policy can replace one’s income in case of death or disability.

According to investopedia.com, Insurance is defines as contract (policy) in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. The company pools clients’ risks to make payments more affordable for the insured.

One of the method in calculating the amount of insurance is through DIME method. D – Debt, I – Income, M – Mortgage, E – Education.

The Debt shall be equal to the combined credit card, loans and other debts.

Income shall be equal to income replacement for 10 years. Sometimes it is also calculated as (Monthly Salary x 12 / Expected rate of Return), with this calculation it is anticipated that money received from insurance company will go to an investment portfolio and its interest will become the living allowance of the family left behind. Example if you earn Php 20,000 and an expected investment rate of return of 8% per year. Calculation shall be as follows:

Php 20,000 x 12/0.08 = Php 3,000,000, therefore your insurance coverage shall be Php 3,000,000.

There are some financial guru suggesting that a 5 years’ worth of salary is enough to let the remaining partner recover from the loss of their partner. In reality all fathers should have an insurance.

The mortgage shall be the total balance of mortgage to be paid.

Education shall be the amount of money to spend for the education of your children in the future.

Here are the reason why you need insurance:

- As mortgage protection

- For income replacement.

- For college funding

- Free from the claims of creditors

- No Tax Estate tax

- Can be used as payment for Estate Tax

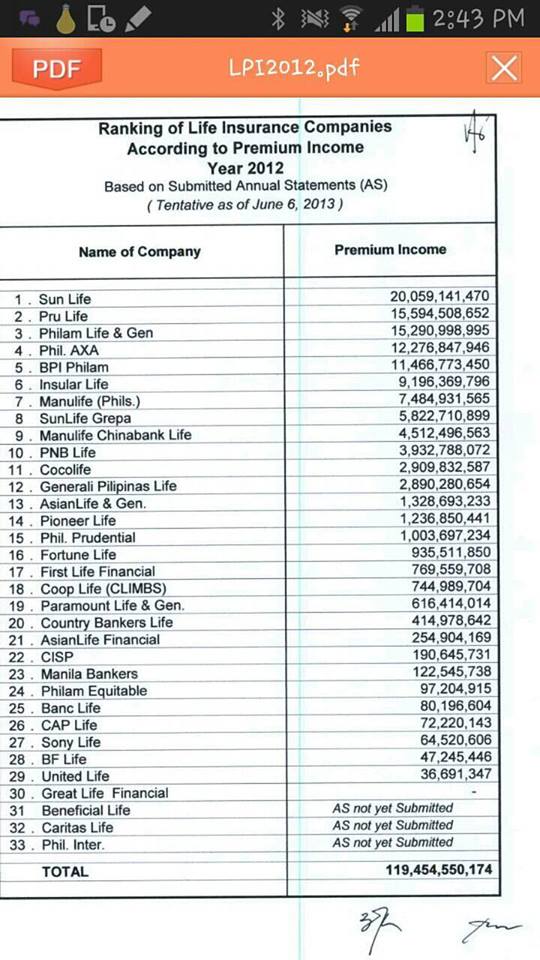

According to the submitted Annual statements of Life Insurance Companies, based on Premium income, a list of top insurance company has been released.

The top 10 companies are as follows:

- Sun life

- Pru Life

- Philam Life & Gen

- Phil AXA

- BPI Philam

- Insular Life

- Manulife (Phils)

- SunLife Grepa

- Manulife Chinabank Life

- PNB Life

See the picture for the complete list

An insurance could also serves as payment for estate tax which is approximately 20% of the estate left by the deceased person. So if nobody is depending on you but you have lots of estate (land, mutual fund, savings account, UITF and more) it is wise to have insurance, so that your beneficiary will not have any problem taking your estate from the government.