In my continued learning about Personal Finance, I came to know that there is Estate Tax in the Philippines. Estate Tax is the tax being charged to any heir of a deceased person.

In my continued learning about Personal Finance, I came to know that there is Estate Tax in the Philippines. Estate Tax is the tax being charged to any heir of a deceased person.

Did you know that all property under your name as shown below is subjected to Estate Tax in case of your death?

a) Real or immovable property, wherever located

b) Tangible personal property, wherever located

c) Intangible personal property, wherever located

All mentioned property would be subjected to Estate Tax equivalent to almost 20% of the Net property. Property includes Real State, Money in the Bank, Mutual Funds, Stocks in the Stock Market and more.

According to BIR the following items will be deducted from the Gross Asset to get the net value of the Net value to be taxed.

- GSIS proceeds/ benefits

- Accruals from SSS

- Proceeds of life insurance where the beneficiary is irrevocably appointed

- Proceeds of life insurance under a group insurance taken by employer (not taken out upon his life)

- War damage payments

- Transfer by way of bona fide sales

- Transfer of property to the National Government or to any of its political subdivisions

- Separate property of the surviving spouse

- Merger of usufruct in the owner of the naked title

- Properties held in trust by the decedent

- Acquisition and/or transfer expressly declared as not taxable

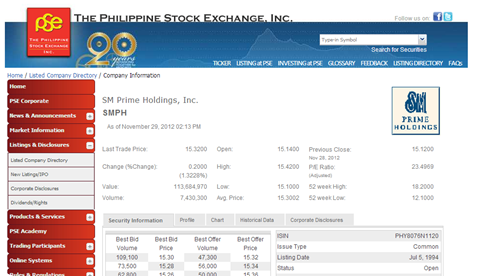

It was also a discussion in the TGFI Facebook group that if the owner of the stocks became deceased, stocks will not be withdrawn or liquidated as along as the real estate is cleared and paid. Joint account can’t also protect the account since if either one of the account holder died, the account will be frozen and will be subjected to Estate Tax.

There is a deadline in paying the Estate Tax as shown in the BIR page as follows:

File the return within six (6) months from decedent’s death. However, the Commissioner may, in meritorious cases, grant extension not exceeding thirty (30) days.

The Estate Tax imposed shall be paid at the time the return is filed by the executor or administrator or the heirs. However, when the Commissioner finds that payment on the due date of the Estate Tax or of any part thereof would impose undue hardship upon the estate or any of the heirs, he may extend the time for payment of such tax or any part thereof not to exceed five (5) years, in case the estate is settled through the courts or two (2) years in case the estate is settled extra-judicially.

According to experts, in order for us to be protected we need to make sure that we have Term Insurance or any other Insurance. Term Insurance is the Insurance with the lowest premium but there is no Return of Investment for any payment. So it is just like paying insurance for your car. But instead of paying for your car you are protecting yourself for anything that might happen in the future.

So it is very important that if we have an asset, we need to make sure that our family is prepared in paying the estate tax in case of death.

For further reference about the Estate Tax please proceed to BIR Page here. Be informed that nobody is excused due to the ignorance of the law.

Image Source : Blog.nolo.com

Many think that all debt is bad and there is no good debt. Now let me just share you some thoughts on what I understood about the bad debt and the good debt.

Many think that all debt is bad and there is no good debt. Now let me just share you some thoughts on what I understood about the bad debt and the good debt. I actually do not know about the emergency funds, until such time that I have heard about this topic in you tube through ANC Money. Emergency funds is a fund that is ready at any time if the need arise. According to one of the financial adviser that was interviewed in ANC Money, emergency fund shall be at least 3 to 6 months of the monthly expenses of a single individual.

I actually do not know about the emergency funds, until such time that I have heard about this topic in you tube through ANC Money. Emergency funds is a fund that is ready at any time if the need arise. According to one of the financial adviser that was interviewed in ANC Money, emergency fund shall be at least 3 to 6 months of the monthly expenses of a single individual. This is also one of my question in life. I have been working for almost 13 years and yet there are lots of things that I need to accomplish to become a rich man. I am rich spiritually but I think financial resources should follow. Today during my reading of the Cash Flow Quadrant by Robert Kiyosaki, he mentioned that we need to start building list of assets that brings income and not expenses.

This is also one of my question in life. I have been working for almost 13 years and yet there are lots of things that I need to accomplish to become a rich man. I am rich spiritually but I think financial resources should follow. Today during my reading of the Cash Flow Quadrant by Robert Kiyosaki, he mentioned that we need to start building list of assets that brings income and not expenses.